As brick and mortar retailers across the nation struggle to stay afloat financially, it has been reported that Barneys New York, the luxury men’s clothing chain is preparing to file bankruptcy proceedings at some point this month.

People close to the Barney’s business imbroglio told CNBC that the retailers are in the midst of a liquidity crunch that was precipitated by a significant increase in rent at its flagship store in Manhattan. The sources added that Barney’s has retained the legal services of Kirkland & Ellis and financial advisers to help with the impending preparations. The advisers are looking into the exploration of such options that would include a Chapter 11 bankruptcy as well as options that could possibly help in avoiding a bankruptcy filing. The latter option might include a sale of the company or devising a plan to secure further financing to keep the chain solvent.

At this juncture, the sources told CNBC that filing bankruptcy is far from certain and is only being explored to find a way to keep Barney’s alive.

A spokesperson for Barneys told CNBC, “At Barneys New York, our customers remain our top priority and we are committed to providing them the excellent services, products, and experiences they have come to expect.” The spokesperson added that, “our Board and management are actively evaluating opportunities to strengthen our balance sheet and ensure the sustainable, long-term growth and success of our business.”

Barney’s however, is not the only retailer to feel the crunch from online competition. According to the CNBC report, such clothing line competitors as Nordstrom are trading nearly $20 a share lower than a $50 a share buyout offer it rejected two years ago as too low. Saks-owner Hudson’s Bay Company is considering going private after its shares fell nearly 50% in the year through June. Shares of Macy’s are down 40% through the past year.”

Barneys has more than 10 namesake stores in New York, California, Chicago, Massachusetts, Las Vegas, Seattle and Pennsylvania, according to the CNBC report.

The Barney’s flagship store on Madison Avenue in Manhattan is currently owned by Ben Ashkenazy of the eponymously named Ashkenazy Acquisition Corp.

Ashkenazy Acquisition is a New York City-based firm that invests in retail and office real estate and asserts that it has a portfolio of over 100 buildings. Ben Ashkenazy is the chief executive, chairman, and founder of the company. In addition to having 660 Madison in its portfolio it also has other retail condominiums in shopping districts throughout Manhattan. Ben’s father, Izzy Ashkenazy, is a businessman also involved in real estate.

CNBC reported that Barney’s rent skyrocketed from approximately $16 million to around $30 million this past January. CNBC has previously reported that such a significant rent hike would essentially eradicate Barney’s earnings before interest, tax, depreciation and amortization.

In January of 2018, the Jewish Voice reported that veteran Manhattan realtors have speculated that if Barney’s should decide to decamp from their flagship location in Manhattan, then it could translate into a major blow for the Ashkenazy company.

For the last few years reports have emerged indicating that retail rents in Manhattan have seen a significant decrease in price as many retailers have opted to relocate elsewhere and landlords have taken a hit. As the Manhattan market continues to adapt to current retail challenges, it was reported that in the third quarter of 2017, rents declined in 12 of the 16 main retail corridors tracked by CBRE, with the overall average asking rent falling 13.4% year-over-year. In tandem, the number of direct available ground floor spaces declined for the second consecutive quarter, dropping 2.5%, from 202 to 197 spaces. Despite the decline, availability remains high relative to 12 months ago.

In June of 2001, it was reported that Ben Ashkenazy paid $135 million to buy the Barneys New York store on Madison Avenue. It was also reported that his company purchased the freestanding Chicago and Beverly Hills stores for an additional $55 million from the Japan-based Isetan Corp. At the time, the New York Post reported that Ashkenazy obtained $135 million in financing from CDC Mortgage Corp. while the rest was provided in equity from “family and friends.”

In August of 2014, it was reported that Ashkenazy Acquisitions was in contract to buy the original Barney’s building at the corner of Seventh Avenue at West 17th Street. Ashkenazy paid the Rubin Museum of Art $60 million for the 45,000-square-foot space. The museum, which bought the building at 115 Seventh Ave., along with the adjoining 138-154 W. 17th St., for $20 million from Barney’s founders, decided that selling the property was in its best interest, according to a NYP report in 2014.

As many retailers and major department stores are fighting for their financial lives, CNBC noted that many retail landlord’s in midtown Manhattan “made investments in their property when retail was stronger, either by buying at high prices or taking out large loans predicated on high valuations. The rent they charge is a reflection of those valuations. As retail has struggled and sales have slumped, the disconnect has hurt both tenant and landlord.”

In January of this year, the iconic Lord & Taylor department store closed its Fifth Avenue location and designer Ralph Lauren was compelled to shutter his Fifth Avenue store in 2017.

CNBC has reported that since 2012, Barney’s has received financial backing from Perry Capital, the fund operated by Richard Perry. Four years later, Perry has closed his fund, saying that market and industry headwinds were the cause. Since its closure, Perry Capital has continued to own Barneys but has not invested any more money into it.

CNBC noted that Barney’s does about $850 million in sales. The retailer extended the term of its credit line by $50 million in April, in hopes of a lifeline. Still, the credit agreement with existing lender Wells Fargo and new lender, TPG Sixth Street Partners, has not been enough to siphon the losses.

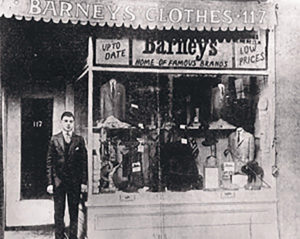

Barney’s is almost a century old, having been founded in 1923 by Barney Pressman. Its original location was at Seventh Avenue and 17th Street in Manhattan and it operated as a men’s discount clothing store. The store made a transition to the luxury market in the 1960’s with the help of Barney’s son Fred. Soon thereafter, Barney’s acquired a stellar reputation as a luxury men’s fashion house and featured such internationally renowned designers as Giorgio Armani.